BRITTMAN

Well-known member

ND and MI have tax reciprocity laws. If you are a ND resident, you can work in MN and pay ND taxes (not tax free, but it is far, far less than MN).

Michigan of all places ... strange one.

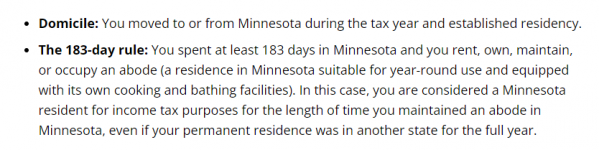

Per MN Tax Department:

Michigan of all places ... strange one.

Per MN Tax Department:

Last edited: